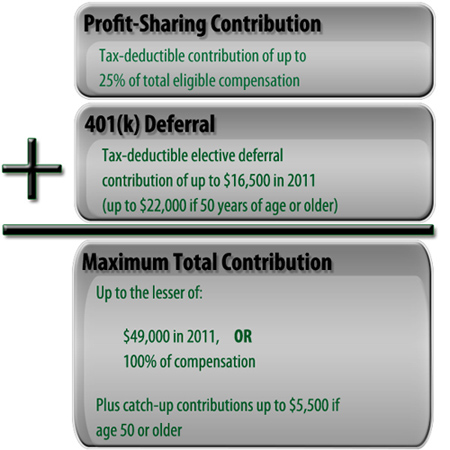

Individual 401(k) Illustration

If you are a self-employed individual or small business owner with no full-time employees (other than your spouse), then an individual or "solo" 401(k) will allow you to maximize retirement contributions by combining 401(k) compensation deferral with profit-sharing plan contributions. Depending on the amount of self-employment or small business income you want to defer, an individual 401(k) may be an attractive option.

|

|

sign up for our newsletter

Check our latest published newsletters or read through our archive. If you are interested in accounting updates in your industry, we'd like to have you on our mailing list.

>

|