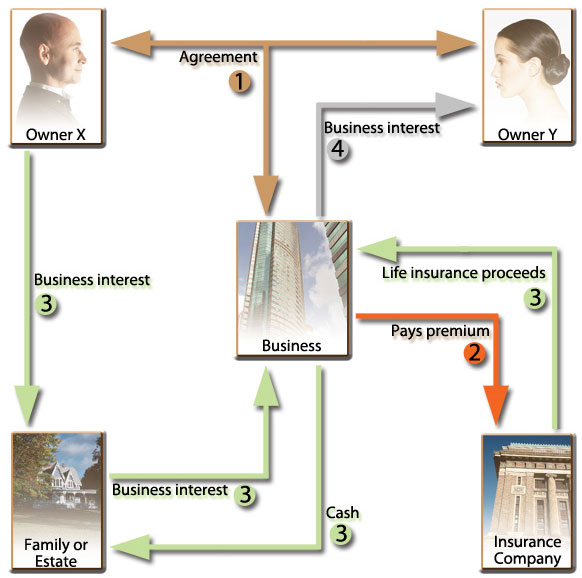

How Entity Purchase Plans Work

1. The owners enter into an agreement with the business. The agreement requires that, at the death of an owner, his or her share of the business will be sold back to the business.

2. With this agreement in place, the business buys individual insurance policies on the life of each owner. The purchase of life insurance ensures that funds will be available for the business to buy a deceased owner's stock.

3. When an owner dies, the owner's business interest passes to his or her heirs. The business collects the insurance proceeds from the insurer and uses that money to buy the business interest from the deceased owner's estate.

4. When the deceased owner's interest is bought back, each surviving owner's share of the business is increased proportionately.

|

|

sign up for our newsletter

Check our latest published newsletters or read through our archive. If you are interested in accounting updates in your industry, we'd like to have you on our mailing list.

|