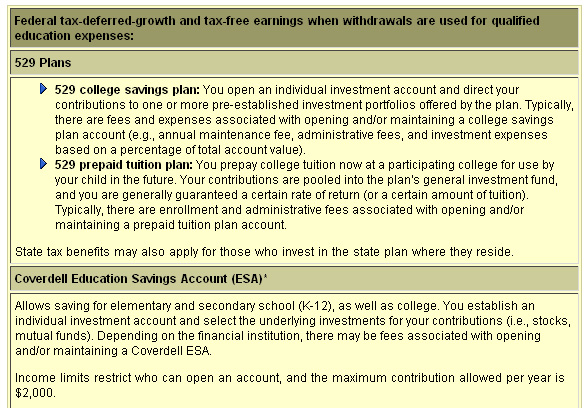

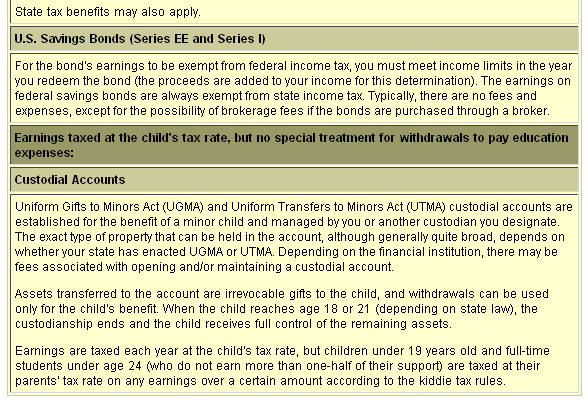

Summary of Tax-Advantaged College Savings Options

*The provisions of the Economic Growth and Tax Relief Reconciliation Act of 2001 that raised the annual contribution limit for Coverdell ESAs to $2,000 will expire on December 31, 2010. Unless Congress extends the law, after December 31, 2010 the annual contribution limit for Coverdell ESAs will revert to $500, the limit in effect prior to January 1, 2002. Investors should consider the investment objectives, risks, charges and expenses associated with 529 plans carefully before investing. More information about 529 plans is available in the issuer's official statement, which should be read carefully before investing. Also, before investing, consider whether your state offers a 529 plan that provides residents with favorable state tax benefits. The availability of the tax or other benefits mentioned above may be conditioned on meeting certain requirements.

|