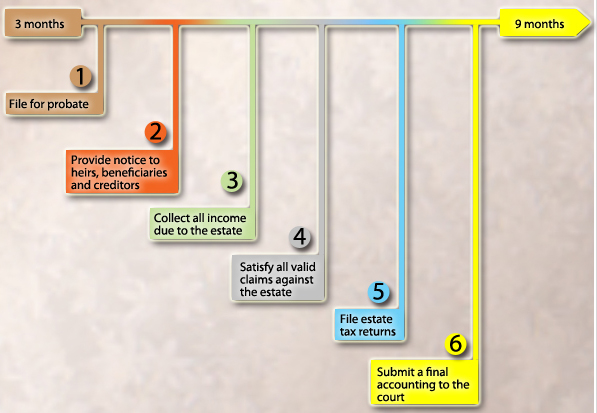

The Probate Process: 3 to 9 Months After Death

- Petition the appropriate court for probate.

- Place a legal notice in the paper to notify unidentified

heirs and creditors. Contact named beneficiaries and known

creditors directly.

- For example, if the decedent owned investment property,

rents will need to be collected.

- This includes expenses, debts, and bequests (paid out in

that order). Court permission may be required before writing

checks through the estate account--keep meticulous

records.

- The federal estate tax return is due nine months after

the date of death. State filing deadlines vary, so check with

the appropriate state agency.

- This is necessary to close the probate proceedings and

relinquish the executor's duties.

|

|

sign up for our newsletter

Check our latest published newsletters or read through our archive. If you are interested in accounting updates in your industry, we'd like to have you on our mailing list.

|