Saving For Your Retirement

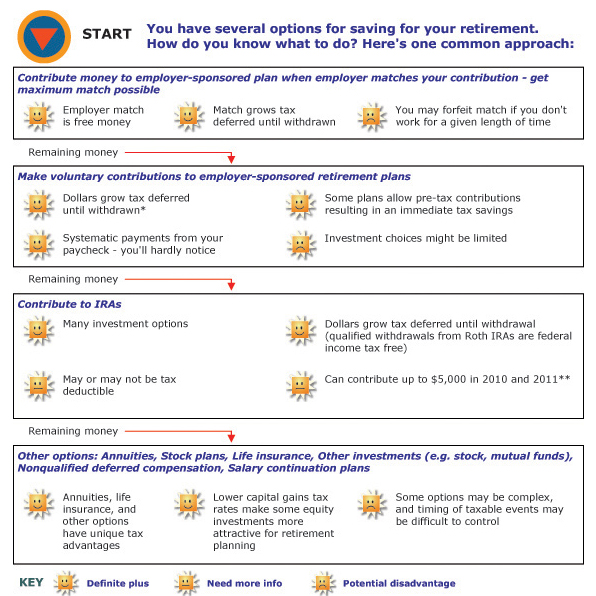

* Beginning in 2006, an employer can allow employees to make after-tax "Roth" contributions to the employer's 401(k) or 403(b) plan. Qualified distributions of these contributions and related earnings will be tax free.

** Individuals age 50 and over may make additional $1,000 IRA catch-up contributions.

|

|

sign up for our newsletter

Check our latest published newsletters or read through our archive. If you are interested in accounting updates in your industry, we'd like to have you on our mailing list.

|