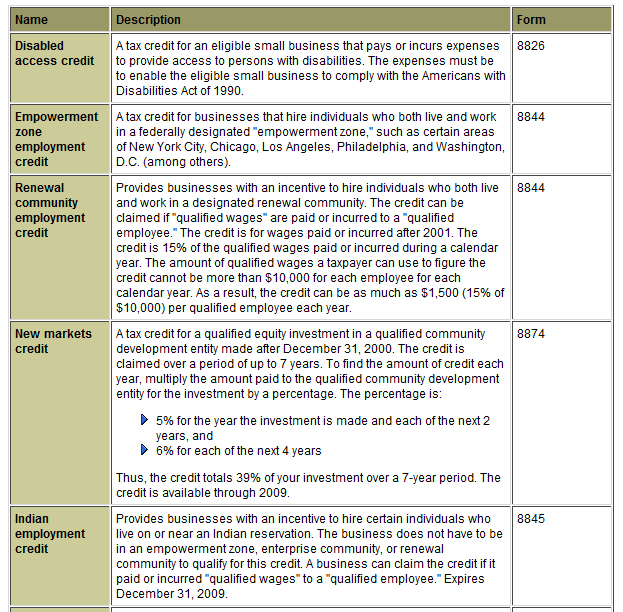

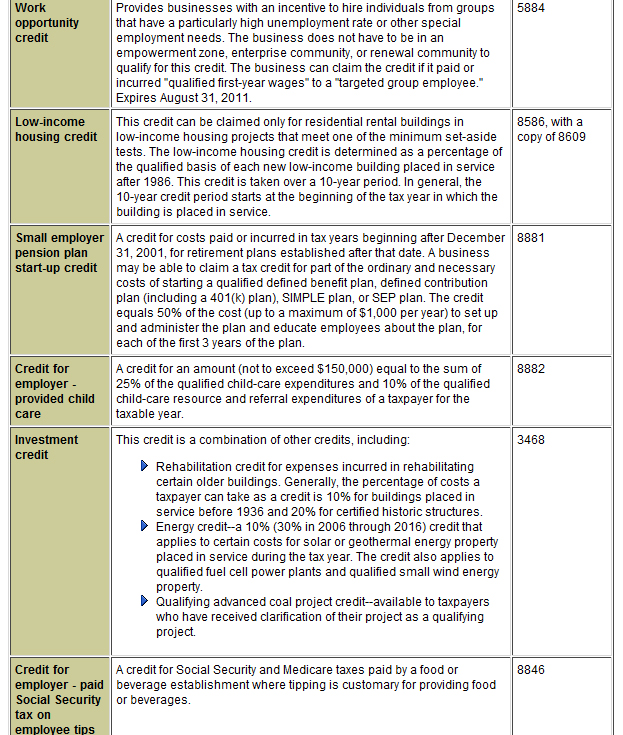

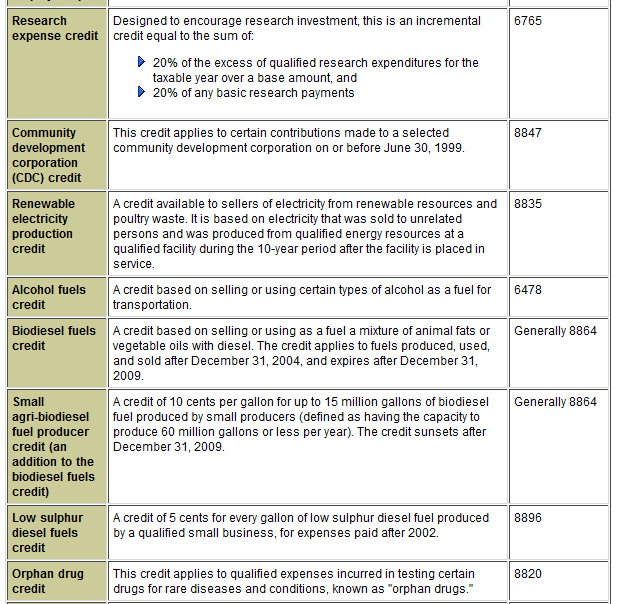

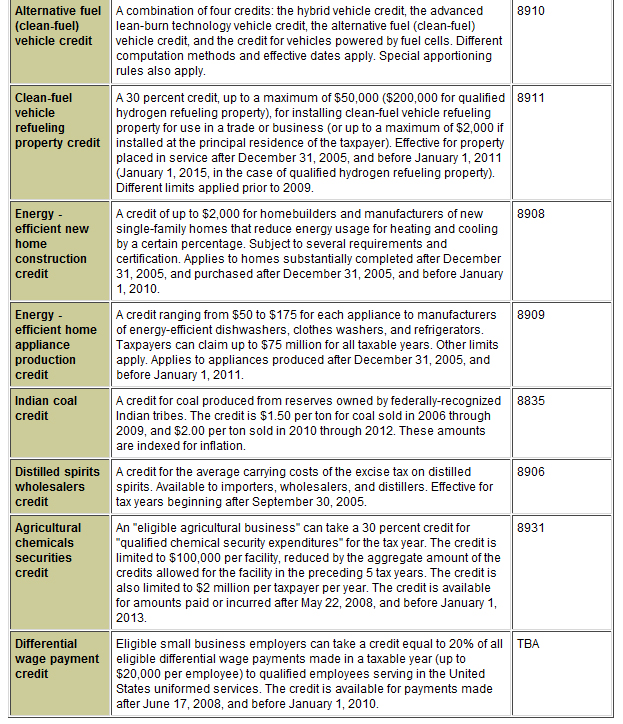

General Business Tax Credits

First established by Congress to further social or economic

objectives such as promoting increased investment in

disadvantaged communities, the general business tax credit is

actually a series of nonrefundable tax credits individuals and

business entities may be entitled to claim. As indicated below,

the calculation of each credit requires a different form to

file with your income tax return (Form 1040 or 1120); if you

claim more than one type of credit, you may also need to file

Form 3800.

|