Tax Credit Sampler

A tax credit reduces the amount of income tax you may have

to pay. Unlike a deduction, which reduces the amount of income

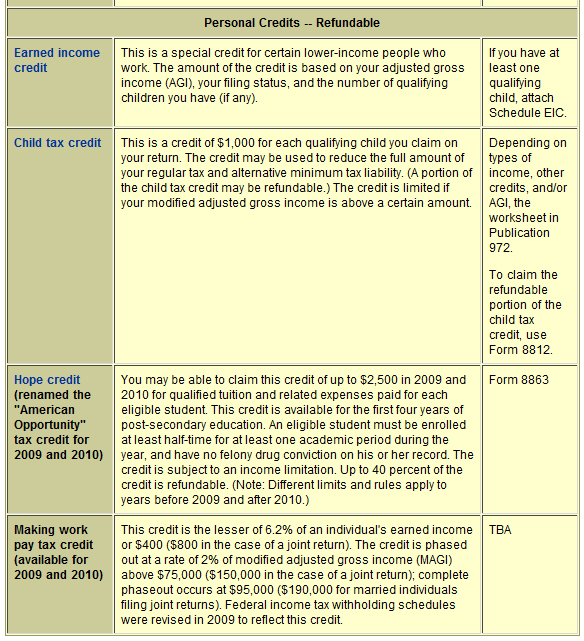

subject to tax, a credit directly reduces the tax itself. Most tax credits are nonrefundable: If the credit amount

exceeds the tax owed, no refund is given. Refundable credits

are different: If the credit amount exceeds the tax owed, a

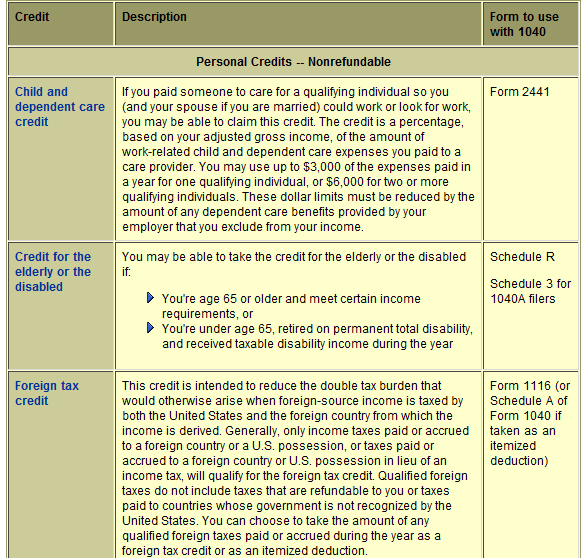

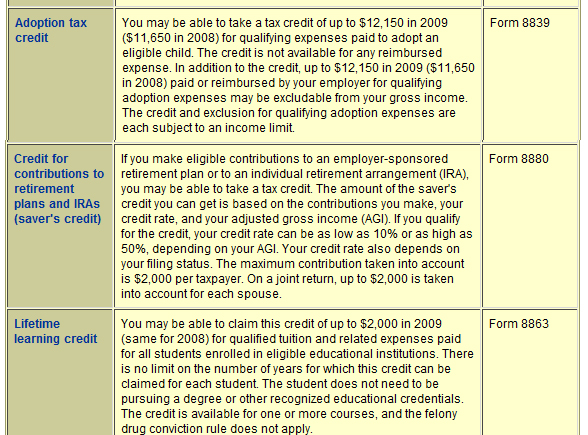

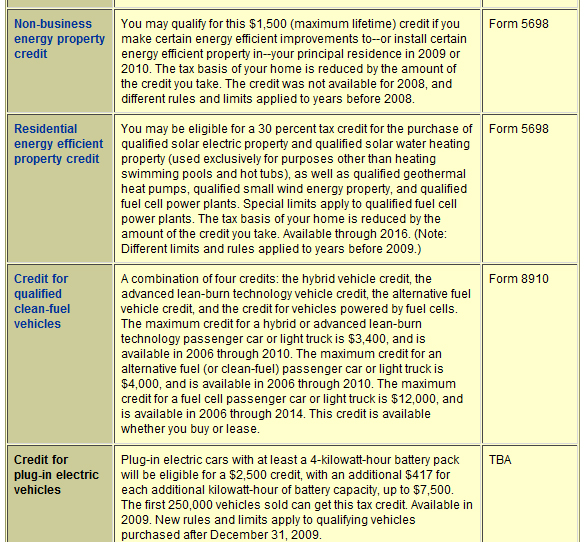

refund may be due to the taxpayer. While not a comprehensive list, the following personal tax credits are of general

interest to individuals (for businesses, see General Business Tax Credits):

|